There are several benefits to using a debit card with an ACE Flare Account. To apply for the card, visit the official website at www.aceflareaccount.com. Not only can you look up past transactions, send and receive funds, and do a whole lot more, but you can also apply for a license.

ACE Flare Debit Card Features

No Minimum Balance Requirement

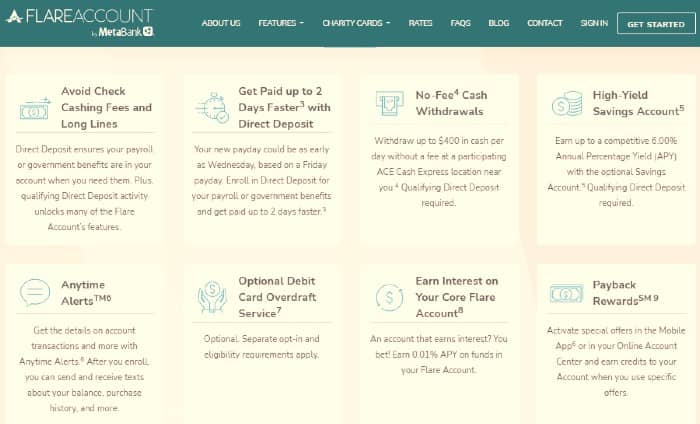

An ACE Flare Account with MetaBank does not need a minimum amount to be established or maintained, which is a notable advantage of this financial institution. In spite of the fact that doing so would result in a monthly cost, you should not allow it to remain dormant.

Earn Interest

Prior to anything else, let us get one thing out of the way. Considering that you are not investing in a mutual fund, the interest that you get will, at most, be considered meager. Nevertheless, you are still getting a good deal for your money. The ACE Flare Account at MetaBank currently provides a dividend of 0.01% per year. This is the current level of payout. If you add the ACE Flare Account by MetaBank Savings Account to your portfolio, which may not seem like much at first, you could be able to increase your earnings.

Solid ACE Flare Account by MetaBank mobile app

You may access your ACE Flare Account from any mobile device with the MetaBank app. Despite its lack of flash, the app is great at keeping you motivated. Use the Netspend Pre-Funded Check Service if you’d like, deposit checks, send money to other people, see your account balance and transaction history, and more. One feature that I like about the application is that it allows me to get text messages on my phone if certain things happen in my account.

Accessible customer support

If you would like to talk with a customer care person, you can either send an email or give ACE a call. On the other hand, I believe that one of the issues is that they did not specify when they were available. You’re essentially taking a risk with this.

Electronic statements

Accessing your online account statements is the same as accessing your paper bank statements. But remember that if you don’t want ACE to deliver your statements electronically, you’ll have to settle with paper copies. Since there will be a $5.95 cost associated with electronic statements, it is imperative that you enroll promptly. Unless a transaction was processed during that specific month, statements will be mailed out quarterly.