Ace Flare Login – The ACE Flare is just one example of a prepaid debit card that works much like a checking account. The amount you choose is instantly added to the card.

You may think of the ACE Flare card as a regular debit card with a few extra features. The ACE Flare Card may be used anywhere Visa is accepted.

With the ACE Flare Account, you may spend as much as you want without worrying about interest building up on your card. When using the ACE Flare Card, be mindful of the limitations on both purchases and withdrawals.

Once logged in, you’ll have access to features including pre-funded checks, transaction history, instant messaging, account balance monitoring, and mobile check capture for adding funds.

One interest-bearing prepaid option from MetaBank is the ACE Flare Account. Optional savings accounts with annual percentage yields (APYs) of up to 5% and early direct deposits are exceptional features. You can’t get free withdrawals unless you meet certain Direct Deposit requirements and don’t waive the monthly fee.

How to Sign Up On ACE Flare Login Portal?

Applying for an ACE Flare Card may be easier if you follow these steps:

- For access to www.flareaccount.com, please click here.

- Please click on the link provided to get to the ACE Flare Login page.

- It is imperative that you choose the Get a Card option.

- Kindly go to the next step for the ACE Flare Card application.

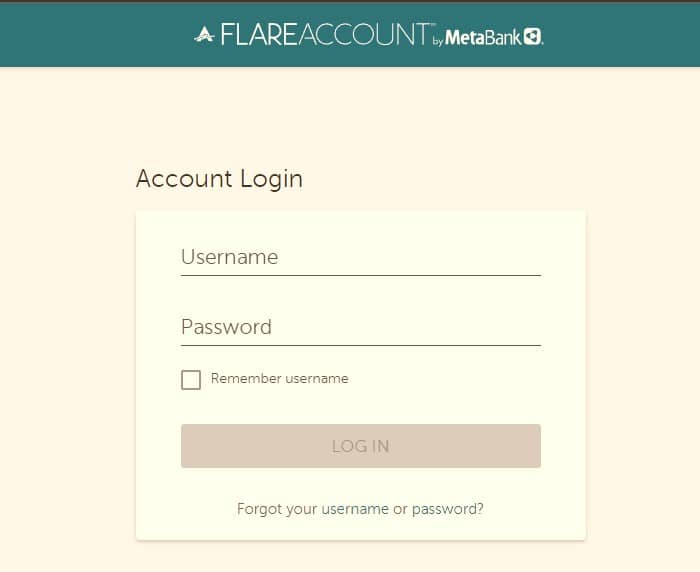

What Is The ACEFlareAccount Login Procedure?

You may access your ACE Flare account on the Meta bank website. Meta Bank’s internet interface and mobile app both allow you to log in. Any smartphone running either Apple or Google’s mobile operating system may use the ACE Flare app.

The ACEFlare is backed by MetaBank. As a result, the bank provides account administration and application capability. You will be able to log in whenever and wherever you choose after you have mastered the process. If you need more assistance with the account login process, there is a detailed tutorial available to you as well.

Accessing your account requires going to the following URL: www.aceflareaccount.com.

“Sign In” is the first thing that users see when they load the page in the navigation bar.

Fill out the white areas with your username and password.

Press the “Login” button to access the account.

Forgot Your Username Or Password?

To begin using ACE Flare, visit the login page.

To recover your username and password, click the “Forgot your password?” option that is available beneath the login form.

Clicking on it will take you to the next page.

Put your email address in the box if you’ve forgotten your username.

Please provide your username and email address in the event that you have forgotten your password.

How to Activate ACE Flare Card

Online Activation Method:

With ACE Flare, activating your card online is fast and easy. To activate your card, you will need its number and security code. You may activate your ACE Flare debit card by following these easy steps:

Visit www.aceflareaccount.com/activate to begin the activation process.

The website where you may activate your card will load when you click the link above.

Enter the card number and security code where asked.

Click the Continue button once you’ve entered your login information into the corresponding areas.

Then, to complete the activation procedure, just follow the on-screen instructions.

Activate Card by Phone

You may also activate the ACE Flare Card using your phone. Call 1-866-753-6355 on your phone to obtain the details. Simply follow the on-call instructions after dialing this number. Please ensure that your payment details are readily available so that we can complete the payment.

ACE Flare App For Mobile

You may access your account information from any location with the ACE Flare App. Take advantage of the optional Netspend Pre-Funded Check Service, add funds to your account, send money to friends and family, see your transaction history, and check your account balance all with Mobile Check Capture.

How Does ACE Flare Prepaid Debit card Work?

The ACE Flare app gives you the freedom to handle your money whenever and wherever you choose. Online Account Center and the ACE Flare mobile app are just two examples of the many technological advancements that have simplified account management.

Keep tabs on what matters most with the helpful tools at your disposal. Plus, by enabling benefits in the app or Online Account Center, you may earn cashback incentives that will be credited to your account.

If you have an Android or iOS device, you can get the ACE Flare app from the respective app stores. You have the option to sign up for notifications by text message or email so you can be informed about your deposits, transactions, and more. Feel free to see your balance whenever you want.

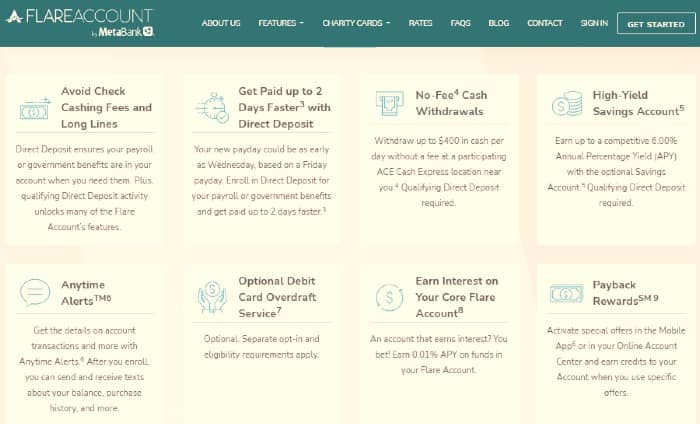

Benefits Of ACE Flare Debit Card

The ACE Flare prepaid debit card is very much like a bank account in operation. The money will be loaded onto the card quickly so you may access it whenever you need it. In addition, the card is functionally equivalent to a regular debit card, so you may use it as usual. It may be used wherever that accepts Visa.

With the ACEFlare Account via MetaBank, you’ll earn interest on your balance, but it won’t be substantial. Nevertheless, you are permitted to use the card for a maximum of twenty transactions each month.

For both purchases and withdrawals, it is vital to understand the card’s limits. You are allowed to spend a maximum of $5,000 in a single transaction when utilizing pin-based transactions, such debit cards. Also, you may withdraw up to $5,000 without going via an ATM. There is a daily limit of $400 and a transactional maximum of $1,000 while using an ATM.

In addition, you may sign up for a bill-paying service with the card. When you set up automatic payments on your Verizon account, you may pay your phone bill every month from your ACE FlareTM Account by MetaBank account. Be aware, too, that using a debit card to pay at certain plACEs (like as your local utility company) can incur fees.

Beyond just a debit card, a flare account offers a lot more. Using the ACE Flare Card grants you access to the following perks:

- As soon as you sign up for direct deposit, your paycheck or government benefits will be sent to your Flare account. You will be able to access your Flare Account features after the necessary Direct Deposit has been made.

- Direct deposit allows you to get your money up to two days faster with the ACE Flare MetaBank debit card.

- You may get data about your account transactions and more with Anytime Alerts. Send and receive SMS updates on your balance, recent transactions, and more.

- An annual percentage return of 0.07% will be applied to funds held in the Flare Account.

- You may withdraw up to $400 in fees-free cash from participating ACE Cash Express locations. In order to withdraw the money, you must meet the requirements for Direct Deposit.

Pricing For ACE Flare MetaBank Account

You may establish a free ACE Flare Account with MetaBank online or over the phone. However, if you choose to apply for a card in person, you will be charged $3 for the application. Additionally, a minimum balance is not required to open an account.

One may open one of two MetaBank ACE Flare Accounts: The first one is a $9.95 monthly fee that applies if you do not already have Direct Deposit set up. Second, your monthly fee might be reduced to $5 if you can arrange a Direct Deposit of $500 or more each month.

Additional costs associated with the ACE Flare Account with MetaBank are as follows:

- Direct deposit has not been initiated with any amount.

- The fee of a withdrawal from an ATM in the US is $2.50.

- Withdrawals made from international ATMs incur a fee of $4.95.

- A 3% fee is applied to all international transactions.

- When you check your account by email, SMS, or mobile app, you won’t have to pay the $1.00 balance inquiry fee (whether it’s domestic or international).

- There is a $2.50 fee for withdrawals made at the counter.

- You will not be charged for a stop payment.

- You can get your statements online for free, but shipping them will cost you $5.95.

- Each replacement or additional debit card costs $3.95, while personalized cards cost $4.95.

- The fee for a customer service representative will be just $4.95 if you do the account-to-account transfer online.

About ACE Cash Express

Financial services provider ACE Cash Express, Inc. has its main office in Irving, Texas. Retail customers of American Express (ACE) have access to a wide variety of financial products and services, including short-term consumer loans, debit card services, money transfers, bill payment, money orders, and check cashing. Through its brick-and-mortar stores and website, ACE caters to customers in twenty-four states plus DC.

ACE Cash Express is the proud owner and operator of many of the nation’s most prominent check-cashing outlets. Easy and fast access to financial services is what ACE offers to clients who are seeking alternatives to traditional banking relationships.

A state-of-the-art bank account with competitive characteristics was developed by ACE Cash Express with the help of the National Association via Netspend and MetaBank. If you have a convenient banking experience that is individualized to your needs and have the tools to handle your finances the way you want, you won’t ever have to worry about banking again.

Ace Flare Login Frequently Asked Questions

- Question – How does the ACE Flare Account’s direct deposit feature work?

Answer – If you get your wages or government benefits via Direct Deposit, you have access to several of Flare Account’s best features! Take advantage of our no-fee3 cash withdrawals up to $400 each day at participating ACE retailers, open an optional high-yield savings account, use our debit card overdraft, and receive your payments up to two days faster with direct deposit. You may also choose to enroll in our extra services.

- Question – My debit card has not yet arrived; when will it?

Answer – On average, it takes 7–10 business days for a new card to arrive. By now, you should have received an envelope from the ACE Flare Account at MetaBank. Please contact them at 866-753-6355 if it has not arrived after seven to ten business days.

- Question – How can I earn interest on my Optional Savings Account?

Answer – Open a Flare Account Savings Account and earn an annual percentage yield (APY) of up to 6.00% if you have a qualifying monthly direct deposit. Consequently, the funds in your savings account may potentially earn you an income just by being there. Your actual APY is dependent on a number of factors, one of which is the Average Daily Balance.

- Question – What are the steps to get Payback Rewards?

Answer – The Payback Rewards program is now active with your new account! After signing in with your Online Account Center or Mobile App, go over to your Rewards page to see all of the deals you’re eligible for. Visit the participating stores and use your card to redeem the enabled bargains. Your rewards will be deposited into your account at the end of the next month.

- Question – In order to withdraw money, what is the process?

Answer – With a conventional debit card, you may withdraw $2.50 from any ATM, just as with a traditional bank withdrawal. Withdraw up to $400 daily fee-free at any associated ACE Cash Express location with qualifying Direct Deposit activity.